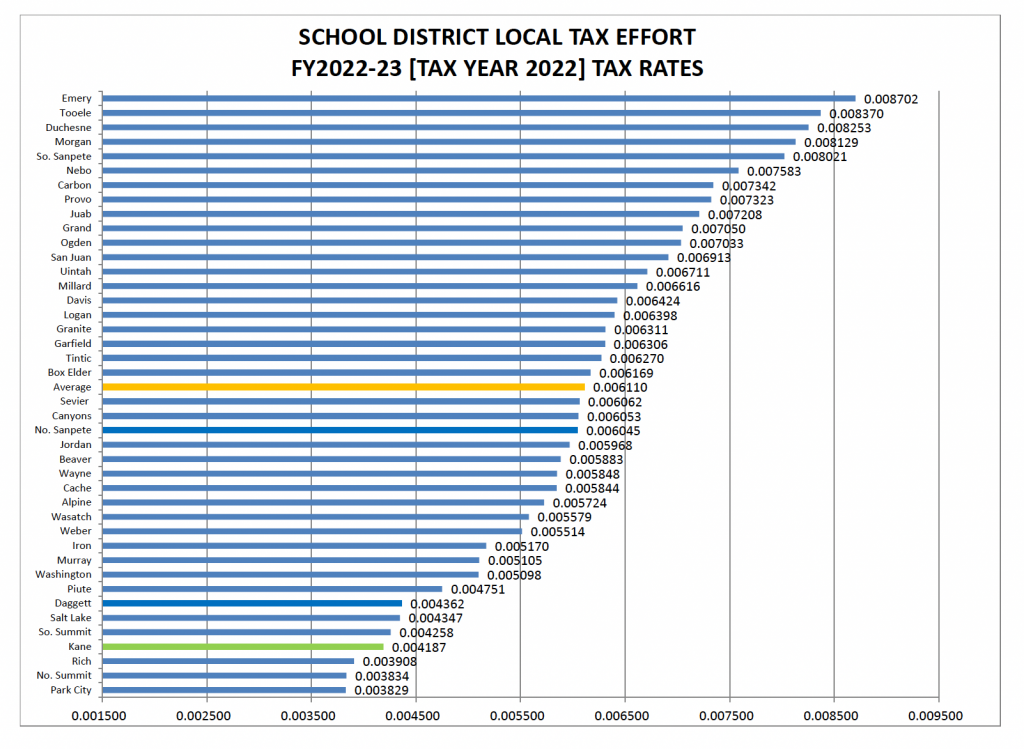

On June 28th, 2022, the Kane County School Board approved the FY2022-23 school budget for the upcoming school year. The budget adoption includes the approval of the local Certified Property Tax Rate. Kane School District assesses the fourth lowest property tax rate in the state of Utah at .004187. The School District Certified Property Tax Rate average for the state is .006110. We are committed as a district to continue to be accountable to the taxpayers with sound financial decisions and staffing ratios. Transparency to the public is also a top priority for our district, you can review budget revenues and expenditures on monthly board agendas on Board Docs https://www.boarddocs.com/ut/kane/Board.nsf/. Additionally, the public has up-to-date access to the expenditures for the new Kanab Elementary School on the board agenda each month. If you have any questions related to the budget or finances, please come into the school district office, where we would be happy to answer any questions you might have. We would like to thank Business Administrator Cary Reese for all his hard work on the budget. For your reference, I have included a list of Utah school districts and their certified property tax rates